How Startups Can Generate Alternative Revenue

One of the most challenging times for an emerging startup, especially a technology-focused one, is the pre-revenue stage. In this stage, all resources are going into building a proof of concept, a minimum viable product, and a marketable deliverable. Sometimes, what is important and what is immediate can’t be easily differentiated. In the case of an early startup where money can mean the difference between life and death of a company, generating revenue from selling supplementary products and services can be one of the most valuable decisions entrepreneurs can make.

There are many examples of technology companies that were able to create and sell side products while developing their great disruptor. The revenue generated by selling their side products fueled the main mission. A delicate balance must be built between relevance, effort, and need. The decision could be to provide engineering services to an industry partner, sell quickly prototyped products to research labs, or even develop a side project that could act as a stepping stone to the next iteration. The possibilities are endless, but the decision has to be made. Below are three important steps that any entrepreneur should take if they are considering bringing a side product to market.

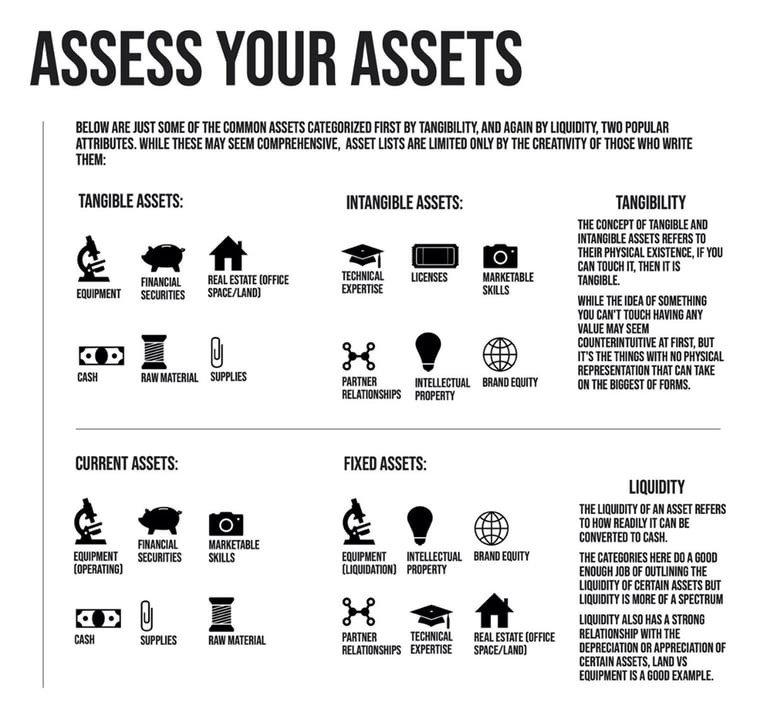

Assess your assets

The first step in determining what you can offer is finding out what you have. This is an exercise that is usually more nuanced than it first appears. Identifying your assets means defining them and their value. We dive deeper into this in the next step, however, for now, let’s focus on identification.

A great example of a company that leverages its fundamental assets is BIC. In 1945, after buying a broken factory in Clichy, France, the European rights for the Ballpoint pen from Laszlo Biro, and Swiss watchmaking equipment, Baron Marcel Bich aimed to make the most affordable and high-quality plastic pen known to man.1 The result can be seen at almost every stationery store in the world: a reliable pen with a transparent design that has been essentially unchanged for the past 60 years.

While the main goal of BIC, in the beginning, was to provide a cheap and reliable alternative to fountain pens, they first had to streamline their manufacturing process and be as precise as possible. This led to lower costs of manufacturing, and thus, a lower price point. BIC’s journey to reach this objective meant that they had to perfect many different processes along the way, which gradually built many different competencies around one product.2

The journey that BIC took enabled them to have experience in many versatile areas such as injection molding, precision assembly, and aggressive marketing campaigns. The success of the BIC Cristal Pen was due to this experience being put to good use. Focusing on the process rather than the product meant that every aspect of the system was scrutinized and optimized, mitigating potential problems down the line.

Identifying assets and core competencies can be hard to uncover sometimes, but they are the most valuable assets any business possesses. The core competencies developed by BIC in the process of manufacturing the Cristal Pen enabled them to diversify quickly and affordably into razors, lighters, and even sports equipment.3

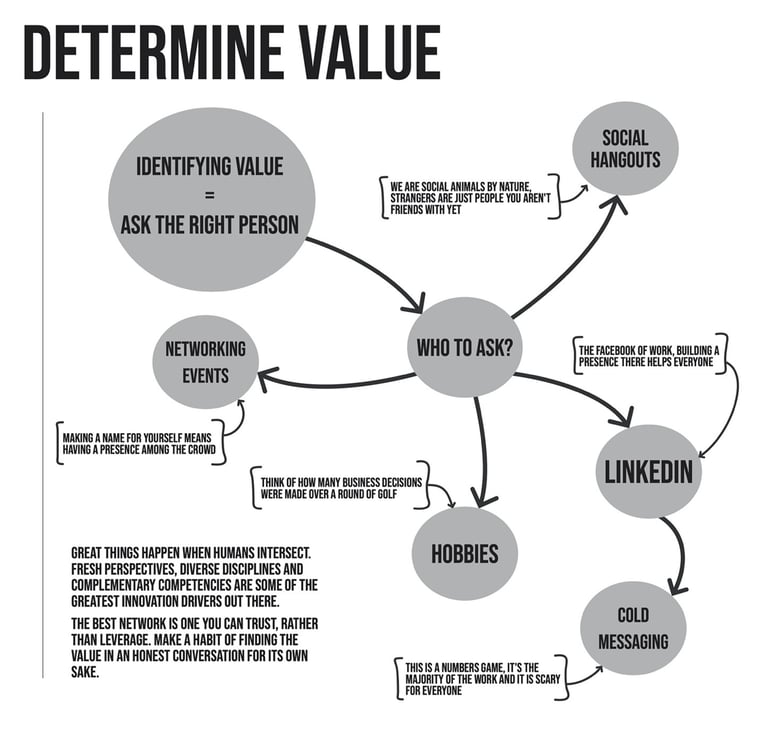

Determine value

Having a comprehensive list of what a startup can do is great, but how valuable is it? That is a question that can only be answered by the entrepreneur. Determining the value of an asset is important, but it can be tricky, and there are numerous ways to do it. Value is hard to quantify because it is subjective. A good analogy would be asking a Tesla owner and a truck driver what their opinion on the price of oil is: one would not care and the other would complain.

Mirametrix, a TandemLaunch portfolio company, specializes in attention and gaze tracking. The main value proposition was a software-based technology that could sense user attention. The use case for the Human Computer Interface alone was huge and involved a long, expensive road to go from pitch to product.4 Despite its success, Mirametrix had to create an eye tracking algorithm, which, back in 2013, was quite novel.

The company’s main focus was to get an MVP off the ground as soon as possible, but by reaching out to various research groups and game developers, the team realized that the eye tracking technology that was operational right now would also solve many other problems faced by the potential customers they contacted. Mirametrix was able to quickly build and sell eye tracking devices while maintaining focus on their core value proposition all at the same time. By doing so, they earned revenue, recognition, and a strong reputation with customers which is crucial in the early stages of a startup.

Quantifying value is subjective, so ask as many people as you possibly can. If Mirametrix had never reached out to game developers and research groups, they would have never known that what they saw as another piece of the patent puzzle was invaluable to the right customer. Networking, outreach, and conversations with different people can bring about different solutions to your problems. You are only limited by missed opportunities.

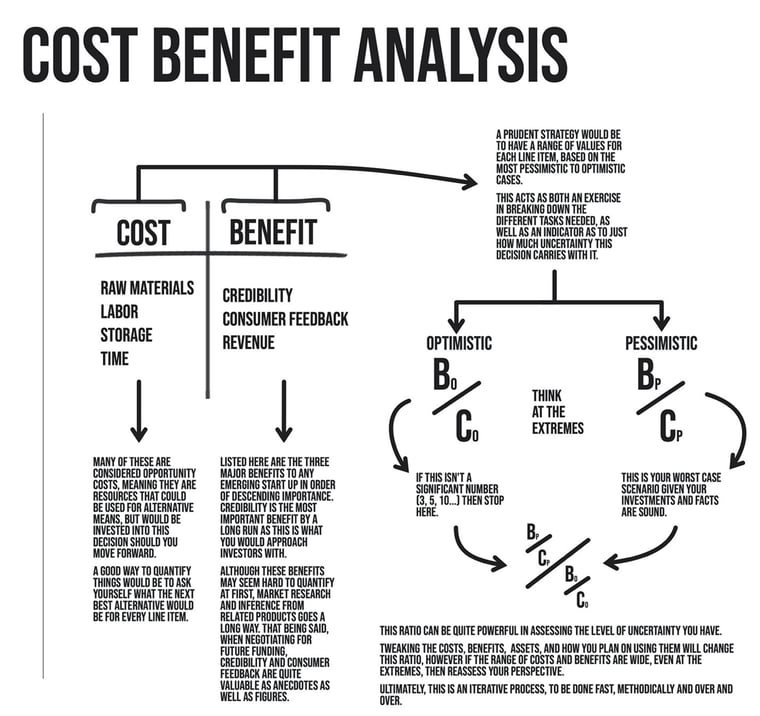

Cost-Benefit Analysis

Once you’ve identified your assets and believe they’re valuable to your target audience, it’s easy to call it a day and start selling. However, the most important step in the process is making sure the outcome is positive, and that’s where a Cost-Benefit Analysis (CBA) comes in.

A CBA is a quantifiable method of weighing out what you can invest versus what you will gain from that investment. You need to make sure that the cost of your investment always stays lower than the benefits in any given decision. This framework is widely used for short-term projects where the variables involved can have monetary value. For this reason, listing your assets and assessing their value is an incredibly important step.5

ORA, an audio-based TandemLaunch startup, is a great example of a business that took a calculated risk.6 They built a Kickstarter campaign in which they used their technology to manufacture high-quality headphones using graphene oxide. This was a great way to raise revenue, however their decision wasn’t based on financials alone. Before approaching investors, they were able to gauge their market, make a name for themselves, and gain valuable customer feedback.

Before deciding to have a Kickstarter campaign, ORA’s founders assessed the decision by conducting a CBA. They weighed the costs of manufacturing the headphones in a small facility versus the benefits previously mentioned in this article. The benefits clearly outweighed the costs, but that did not make the decision risk-free. The founders of ORA had no previous manufacturing experience. A major advantage of carrying out a CBA is forcing you to think about all the challenges you need to overcome, and inexperience is one of them.

ORA is still standing today, not because they were able to have an accurate CBA to guide them, but because they realized the multiple intangible benefits outweighed the costs. As thorough as they can be, most of the time, a CBA will not provide all of the information. Opportunity cost and certain benefits such as credibility are among the things that cannot be easily quantified.7

The true strength of a CBA is two-fold: it forces you to critically tackle all the uncertainties and risks that you may not have been aware of, and it makes you discern the risks of your decision. Generally, a CBA is meant to be quick, collaborative, and iterative. You might not get it right the first time, and you might not find a numerical value, but the goal is to find a ratio of benefit to cost that is well above your risk tolerance.8

Shoot your shot

The three steps explained in this article are powerful frameworks to help structure the decision-making process when assessing revenue opportunities. Many sizable investment decisions have been made based on gut feeling alone and while the power of a strong human connection should never be underestimated, it never hurts to be methodical. There are many other tools that help with decision making: some are simple, such as a decision flow-chart, and some are more complex, like a course on game theory. It is crucial to find a framework that works for you and your team. Continuously implementing the framework won’t always be straightforward, but you must persevere.

[1] https://us.bic.com/en_us/corporate-page-our-story-timeline

[2] https://leparticulier.lefigaro.fr/article/il-etait-une-fois-le-stylo-bic-cristal

[3] https://corporatefinanceinstitute.com/resources/knowledge/accounting/types-of-assets/

[4] https://mirametrix.com/

[5]https://web.archive.org/web/20081016040649/http://www.dot.ca.gov/hq/tpp/offices/ote/benefit_cost/index.html

[6] https://www.ora-sound.com/our-story

[7] https://www.investopedia.com/terms/c/cost-benefitanalysis.asp

[8] https://online.hbs.edu/blog/post/cost-benefit-analysis